ingeniousdesign

Wholesale - Finances

Wholesale - Finances

30 in stock

Couldn't load pickup availability

- DL sized notepads (10.5 x 21.0 cm)

- 50 sheets of high quality colour print paper per notepad

- Designed to help you track where your time is going

- Easy to write on

- Designed in Bristol, UK. Made in Germany.

The Problem we were trying to solve

We’re a bit obsessed with budgeting. It got us through the early lean years of business and made unexpected life events less stressful. We did feel that we were often being pushed too much into spending less as opposed to spending well. We really liked YNAB’s policy of giving every pound (or dollar) a job as it helps you see money as a resource rather than something to feel ashamed or guilty about (which seemed to be people’s dominant emotions whenever they were asked about their spending). We found that making a plan in advance was always really helpful, and having that plan focus on positive actions such as saving for specific items rather than just trying to cut spending was also helpful. We really like apps that track our spending, but I’m too lazy to sort the data into something useful.

What we came up with

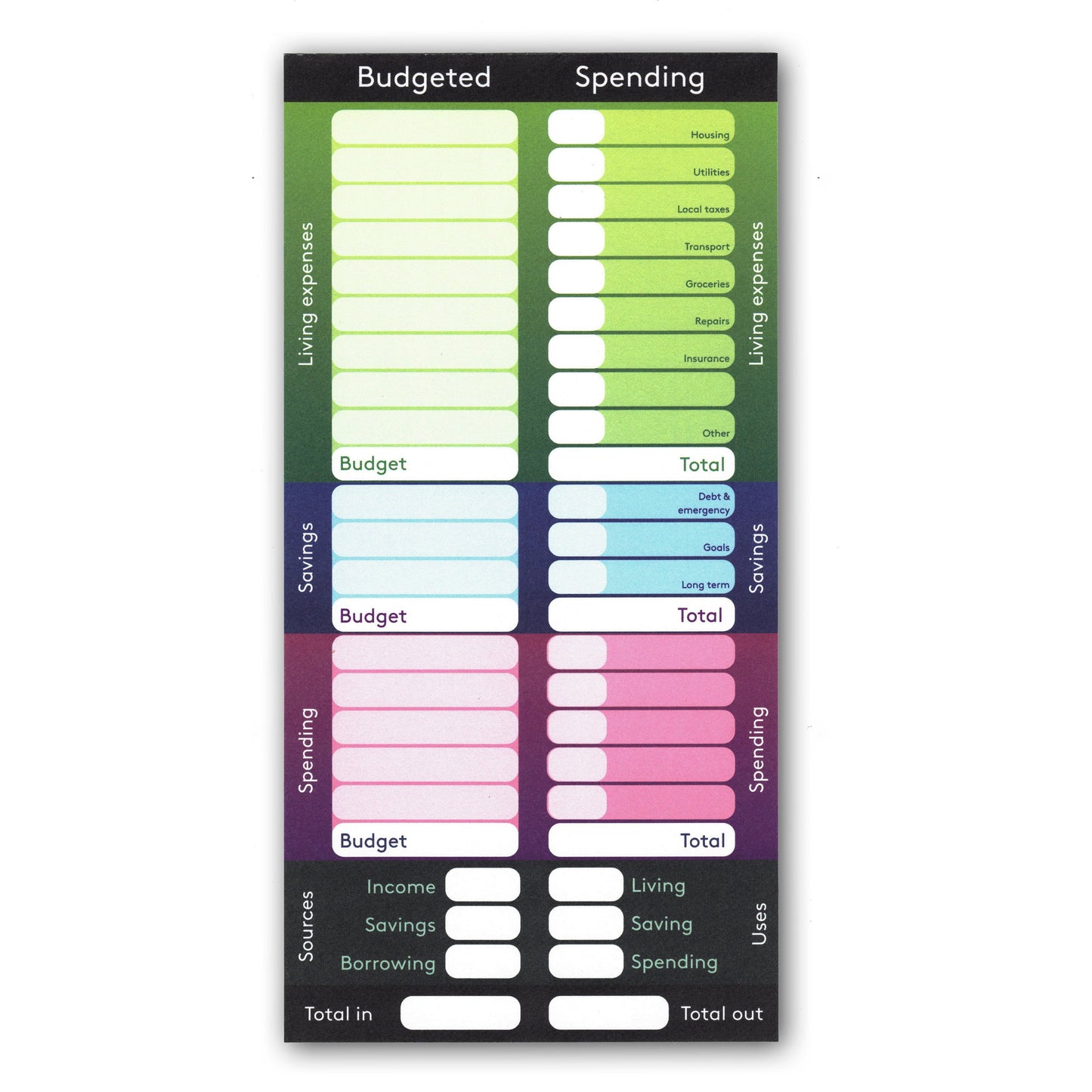

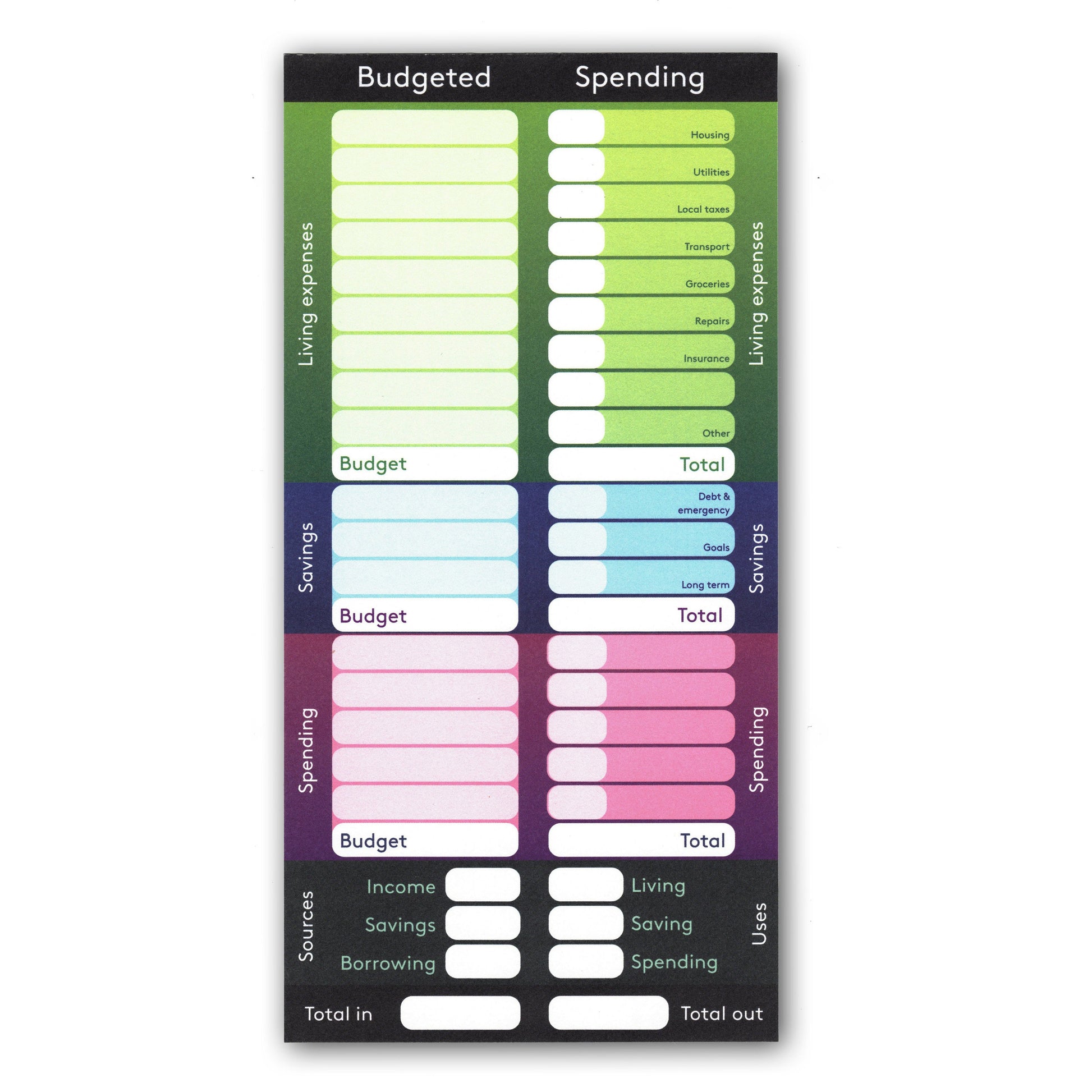

This notepad is based on the principles that all money in should be allocated for a job, and that you should allocate financial resources on a 50-20-30 distribution across essential spending, long term saving, and non-essential spending. At the start of the month, plan your spending ahead and budget for all the money that’s come in. At the end of the month, write down what actually got spent on everything. Use the columns at the bottom to balance the books, either indicating where the extra money came from if you spent too much (savings or credit) and where the extra money went if you spent less that you thought. Ideally everything should balance like a double-entry book-keeping record. To indicate the 50-20-30 we split the notepad categories into three different colours and added a tally at the bottom.

Share